Certification & Licensing

Trademark

Startup

Income Tax

Compliance

Certification & Licensing

Trademark

Startup

Income Tax

Compliance

Certification & Licensing

Trademark

Startup

Income Tax

Compliance

Certification & Licensing

Trademark

Startup

Income Tax

Compliance

At Lincenzo, we are committed to delivering our products and services exactly as promised. If, for any reason, we are unable to fulfill our commitments, we offer a Money Back Guarantee.

How to Request a Refund:

If you wish to request a refund, please write to us at info@lincenzo.com

with the details of your grievance. Our Refund Department will review your request promptly.

Refund Process:

Once your request is received, our team will investigate the matter.

If it is found that Lincenzo did not deliver the services or products as promised, we will process your refund.

Refunds will be credited within 7-10 working days of the approved request.

We value your trust and strive to ensure your experience with Lincenzo is always satisfactory.Once your request is received, our team will investigate the matter.

If it is found that Lincenzo did not deliver the services or products as promised, we will process your refund.

Refunds will be credited within 7-10 working days of the approved request.

We value your trust and strive to ensure your experience with Lincenzo is always satisfactory.

No refund shall be issued if Lincenzo.com has processed your registration/application as per government guidelines and the registration is rejected or pending due to actions or delays from any government department or official.

We may deduct administrative/processing charges of not less than Rs. 300 (Three Hundred Rupees only) if we are unable to process your application due to:

Non-submission of required documents as per government guidelines, or

Any non-cooperation from the applicant, or

Any other circumstance restricting us from processing the application.

Any government fees, duties, challans, or other sums paid during the processing of your registration/application are non-refundable. (Note: No government fee will be deducted until proof of payment, such as a government challan, is provided to you.)

No refund shall be issued if you have already availed any complimentary services or discounts attached to the paid service for which you are seeking a refund. Examples include: one-day ad banner publication, software subscriptions, etc.

No refund will be possible at any stage for subscription-based services, such as GST return packages or annual company compliance packages, even if the service is partially processed or delivered.

Under any circumstances, the maximum refund amount cannot exceed the amount paid by the customer.

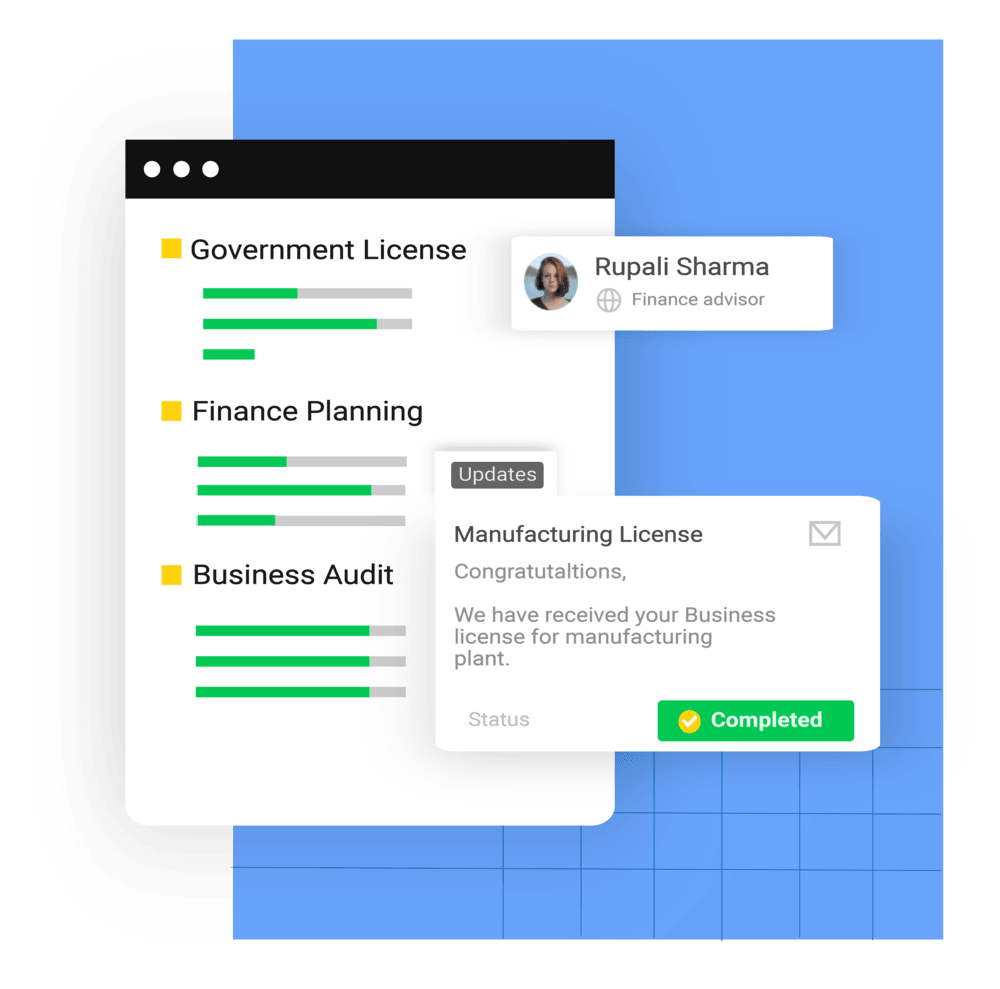

Expert Help for BIS, ISI, FMCS & More — Fast, Easy & Reliable.

Download your free legal guide Now

Feel free to ask any query

At Lincenzo we understand our responsibility

We are India’s trusted business service provider, helping entrepreneurs and companies with registrations, licenses, compliance, and certifications. From startup to scale-up, we ensure hassle-free, fast, and reliable solutions for all your business needs.

Serving Partners

Quick Links

Services

Payment Methods

Get In Touch

Lincenzo Private Limited

Mon - Sat: 10:00 AM - 06:45 PM

Sunday : Closed

Need Help? Contact Us

Lincenzo Private Limited All Right Reserved | Privacy Policy

Rated at 4.9 By 43034 + Customers Globally